We talk about what we would like our bank to be, to our customers, employees, community and shareholders (if we have them). We build a strategy that is more often than not preaching differentiation versus cost advantage. We analyze our customers, markets, and our personnel to devise a plan that has the potential to deliver to our stakeholders.

Then we go back to our day-to-day and do none of the things we talked about. We go back to managing support functions on their budget, delaying strategic investments that could make them more scalable, efficient, and not people-dependent to mitigate the threat of the availability of talent. Because the investment wouldn't yield results until the end of year two, and we got a budget to keep.

We go back to incenting lenders on volume, even though we have a strategic aspiration of being in the top quartile of net interest margin. Our brand, according to our latest Net Promoter Score, should allow us to succeed at not having to be "best price." But we incent on volume because, hey, lenders are accustomed to volume goals, and we can't measure spreads per lender.

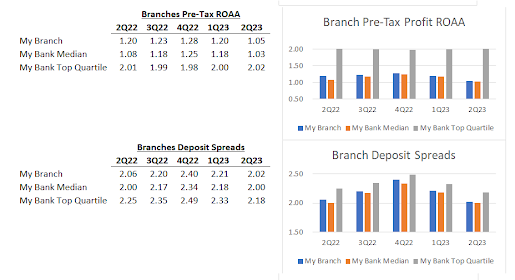

We measure branch managers on deposit growth or open-close ratios. Again, it's easy to pull those numbers. And branch managers don't have the sophistication to understand a branch profit and loss statement, right? And we can't measure that anyway.

So our accountabilities fall on the same old things that are not particularly in alignment with our strategy and likely have unintended consequences that hold us back.

You manage what you measure. And we are selling ourselves, our people, our customers and shareholders short by only measuring what our systems can do. Imagine if a branch manager owned their P&L, and therefore were empowered to make rate exceptions, fee decisions, and budget decisions that are balanced to continuously improve the profitability of their branch. It would certainly bring customers closer to decision makers, which can be a competitive advantage for the community financial institution if only it benefitted from strategic execution.

As I see it, holding employees accountable for their actions, all the way down the line, consistent with strategy, will build that execution culture so many institutions crave. Yet it remains elusive. It doesn't have to be.

I've constructed a branch dashboard that I think will motivate branch people to work every day at improving the financial performance of their branch, and therefore the bank, while giving them ownership of decision-making to benefit all stakeholders.