Another day, another big bank faux paus. On July 10, the Consumer Financial Protection Bureau (CFPB) issued a consent order (CO) against Bank of America, N.A. (BofA), claiming, among other things, that BofA opened credit card accounts for new customers without their consent. The next day, the Office of the Comptroller of the Currency (OCC), exacted a $60 million fine for prior sins that were based on a 2022 exam and subsequent consent order regarding double fees charged to customers as a result of ACH representments.

Not a red-letter day for BofA.

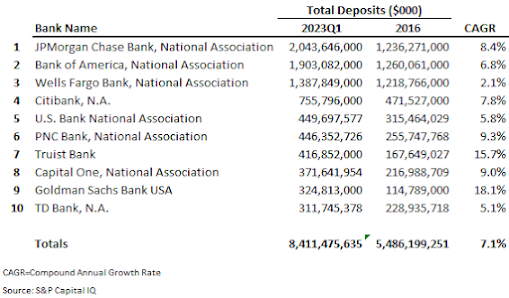

But can it be for the community banks that would covet the customers that make up the $1.9 trillion in BofA deposits?

If past is prologue, we shouldn't get too excited. Wells Fargo was slapped with a similar CO back in 2016, while they were third in the nation in deposit market share. They're still third. Even though a subsequent CO limited their growth to under five percent. The good news is they only grew deposits 2.1% annually, while others in the top 10 deposit market share averaged 7.1% annual growth. But still, Wells grew deposits $169 billion since receiving their 2016 fake account order, which has been subsequently lifted.

So, as I told a banking friend, however community financial institutions react to BofA's wrongdoing, or don't react, it should be different than what we did in reaction to Wells' 2016 CO.

It's not like the BofA news isn't bad. Let me give you some of the CFPB language in the CO in Article IV, subsections 24-31:

Respondent's (BofA) Violations of Law Regarding Account-Opening Practices

24. During the Account-Opening Findings Period, Respondent offered an array of Consumer Financial Products or Services, including savings and checking accounts (deposit accounts) and credit cards.

25. During the Account-Opening Findings Period, one factor that Respondent considered when evaluating financial center employees’ overall performance and incentive compensation was the number of new Consumer Financial Products or Services that were opened and used by the consumer.

26. During the Account-Opening Findings Period, in response to sales pressure or to obtain incentive rewards, Respondent’s employees sometimes submitted applications for and issued credit cards without consumers’ consent. These acts or practices were contrary to Respondent’s policies and procedures and involved a small percentage of Respondent’s new accounts.

27. It was Respondent’s practice to obtain consumer reports in the course of considering consumers for new credit cards.

28. Respondent used or obtained consumer reports to consider consumers for new credit cards even when the consumers had not applied for or did not want the products and where Respondent did not otherwise have a permissible purpose for the consumer reports.

29. During the Account-Opening Findings Period, Respondent sometimes generated associated fees from credit card accounts opened without consumers’ consent.

30. Respondent’s acts or practices described herein may have negatively impacted consumers including through fees charged; impacts to consumer credit profiles; the loss of control over personal identifying information; the expenditure of consumer time and effort investigating the facts and seeking closure of unwanted accounts; and the need to monitor and mitigate harm going forward.

31. Respondent has addressed a root cause of Relevant Account-Opening Practices—individual sales goals and sales-based compensation—by eliminating sales goals both for compensation incentives and for performance management for financial center employees primarily responsible for the sale of consumer credit card accounts as of January 1, 2023.

So What?

In a separate CO, the OCC cited violations of law against BofA for charging customers a $35 overdraft fee, and if re-presented by merchants the next day and there were still insufficient funds, charged an additional $35 fee for the same item. This practice was said to have ended in 2021.

Representment issues and the disclosures were recently a regulatory hot-button issue in bank exams. And, truth be told, others may have done it without even knowing it was being done. These double-fees were not very big to a traditional community financial institution and it is possible when the deposit accounts were set up, they were not set up to identify representments when automatically assessing fees.

But still, the timing of the CO coinciding with the fake accounts opened as a result of the sales culture within BofA is certainly a bad look.

The question; will this bad look result in community financial institutions finally making a successful case to younger depositors and small businesses that their deposit dollars belong with them and not the SIFI banks?

I hope so. But hope is not a strategy.

~ Jeff

No comments:

Post a Comment