Me: Commercial Real Estate loans are the most profitable product in a community bank's arsenal and have been through various interest rate environments.

Bank Senior Lender: Not when you consider the whole relationship.

True, it is more likely that a traditional business borrower has a full relationship with their bank than a typical commercial real estate (CRE) borrower. In a world of limited resources, which should you dedicate resources to pursue? This was the conversation I had with a senior lender of a client at the Massachusetts Bankers' Association annual convention.

And after that conversation, I sat in my hotel room thinking about the right answer. Since I rely heavily on data, I poured through my firm's product profitability reports that aggregates the answers from all of our clients. What does a "full relationship" mean? I thought, business loan plus a business checking account. The much sought after "operating account." How do these products perform through different interest rate environments?

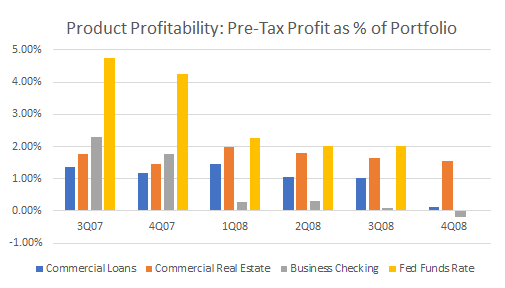

The charts below show the pre-tax profits as a percent of the total product portfolio during different rate scenarios compared to the Fed Funds Rate.

So the answer, from a straight pre-tax profit perspective, is commercial real estate in more recent times and a rising rate environment. In the falling rate environment period between the third quarter of 2007 until the fourth quarter of 2008, when the Fed Funds Rate dropped from 5.25% to zero, you can see from the chart that business checking did quite well in the early quarters because of the lag effect of falling rates on the profitability of non-term deposits. Having a Fed Funds Rate of 5.25% bolsters deposit profitability, as the chart demonstrates. By the time the FF hit zero at the end of 2008, CRE was the last product standing. It would have been more profitable if not for the heavy loan loss provisioning as the economy teetered. Zero rates bolsters the value of loan products as funding costs decline.

But what of the relationship? Take a more normal rate scenario at the end of 2018, when FF stood at 2.50%. The math is in the tables below.

All data are from my firm's product profitability database.

CRE still wins. Why? Two reasons, in my opinion: average balance per account, and operating expense per account. Banking is mostly a spread business, and if you are generating the same spread through a $216,732 balance account versus a $589,949 average balance account, as they were in 2018, then the larger balance account wins. Especially if it takes a similar effort to originate and maintain the account.

In spite of these numbers, I agree with my client that the total relationship commercial loan and business checking customer is more valuable. Just not necessarily more profitable. And banks should determine their "why" and set about to change it.

In the above case, there are multiple levers to press. Lever one, increase the average balance of commercial loans to drive greater spread dollars. This could be through industry specialization, focusing on those that carry greater average balances or utilize their lines of credit with greater frequency. It could be through cost by automating decisioning for smaller loans or, for example, using AI to perform annual reviews or do them bi-annually for loans that meet certain criteria.

Another consideration to improving the profitability of commercial loans is to perform a risk-based equity allocation. I understand this is financial alchemy, but most of our clients allocate more capital to the business loan because it has less reliable collateral. But commercial loans, if analyzed for total risk (not just credit risk), also are typically less risky for interest rate and liquidity risks. A bank that takes a complete view of the risk and therefore the equity needed to support each product type might determine that a commercial loan might require less capital than a CRE loan.

Deposit profitability suffers in a zero rate environment because we are simply not generating enough spread to cover costs. But in a more normalized environment, such as 4Q18, it was profitable and profits were trending better. The pre-tax ROA might not look great. Because there is little credit risk to the product it requires little equity to account for interest rate, liquidity, and operational risk. This creates a stellar PT ROE, the best of the three products measured here.

So even though CRE remains the most profitable product to a community bank, it is not necessarily the most valuable. But we have work to do.

~ Jeff

Nice

ReplyDelete