During a recent discussion with a bank CEO and Chief Banking Officer, a fundamental question arose: Why can't we leverage technology to create a smarter business checking account? Instead of the traditional "Analysis Checking" model, which often erodes potential interest earnings through transaction fees, why not design an account that pays interest based on a technology-determined average balance exceeding a certain threshold?

Given that Dodd-Frank permits interest on business checking accounts, this approach seems logical and customer-friendly. For businesses with higher transaction volumes, the average balance required to earn interest would naturally adjust upwards. This is a concept that is both transparent for the customer and operationally straightforward for bank staff. The average balance calculation could even be reset annually or more frequently to reflect actual account activity. Stuck in our historical paradigm, we don't ask ourselves how to create an easier to understand, more efficient, more transparent, and yes, more profitable business checking account.

The primary objection I've encountered? The bank would lose the fee income generated by Analysis Checking. However, a careful analysis might reveal that the lost fee income would be minimal given that we would charge fees if the account was under its interest-bearing threshold. And likely more profitable.

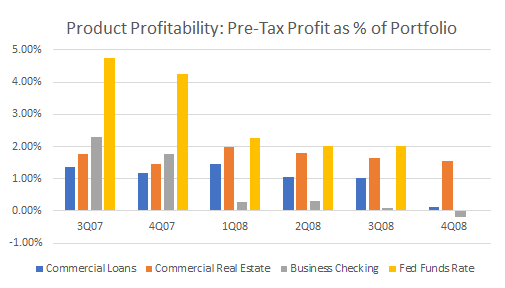

This conversation sparked another critical challenge: How do banks profitably manage large money market deposit portfolios in a rising interest rate environment?

Consider a scenario with $1 billion in money market deposits. When the Federal Reserve raises rates by 100 basis points, the response isn't uniform. Some depositors are highly price-sensitive and expect their rates to move in lockstep with the Fed or just below. Others are "price-interested," perhaps seeking a beta of 50%, while some simply value the FDIC insurance and branch access for their cash accumulation, exhibiting low price sensitivity.

The core problem is the lack of clarity: We don't know who's who. The current approach often involves waiting for customers to inquire about rate changes. However, with technological advancements and the ease of funds transfer, many customers simply moved their money during the recent Fed tightening without a word.

This situation points to several potential shortcomings:

- Customers in the wrong accounts: Are some customers better suited for savings accounts than money market accounts?

- Subpar onboarding: Are we failing to identify the customer's reasons for opening the account and their sensitivity to rate fluctuations?

- Lack of sophisticated systems: Do we lack the tools to differentiate between price-sensitive, price-interested, and price-disinterested depositors?

The knee-jerk reaction might be to split the difference and proactively raise the money market rate by, say, 75 basis points. While seemingly fair, this could result in a significant $7.5 million reduction in net interest income.

I believe these challenges would be significantly mitigated by fostering a strong product management culture within the bank. This would involve establishing a dedicated head of product management and empowering up-and-coming middle managers with the responsibility for the continuous profit improvement of specific products.

Consider a retail money market product. Imagine assigning the VP or regional manager of the branch network as its product manager, directly accountable for its ongoing profitability. This individual could then actively manage various profit levers:

The product management committee meets quarterly to review trends in their products. They review the drivers to improve the profitability of the personal money market product. Some potential solutions from that meeting:

- Pricing Strategies: Dynamically adjusting rates based on customer segmentation and market conditions.

- Product Features: Introducing tiered interest rates based on balances or relationship status.

- Customer Segmentation: Identifying and targeting specific customer groups with tailored offerings.

- Communication & Marketing: Proactively informing customers of rate changes and highlighting product value.

- Onboarding Process: Implementing robust KYC Q&A to understand customer needs and price sensitivity.

- Process Improvements: To lower the amount of bank resources required to originate and maintain the account and lowering the OpEx per account.

Furthermore, the bank could consider developing new, differentiated money market products – perhaps something like "Money Market-Fort Knox" for price-insensitive customers and "Money Market-Wealth Builder" for those seeking competitive returns. This targeted approach would provide clearer insights into customer preferences and potentially prevent the significant outflow of deposits and decline in average balances experienced during the 2022-23 Fed tightening. Proactive engagement, rather than reactive adjustments based on customer complaints, would foster greater loyalty.

The fundamental hurdle, as I see it, is that many banks don't systematically measure the profitability of individual products. And even when they do, it's uncommon to assign dedicated product managers tasked with driving continuous profit improvement.

Should they? Absolutely.

While my firm offers outsourced product and organizational profitability services to banks, I firmly believe that all banks, particularly those with over $500 million in assets, should embrace this level of reporting, regardless of whether they partner with us. Consider this: a mere one basis point improvement in net interest margin at a $500 million bank translates to an additional $50,000 in net interest income. Scale that up if your financial institution is larger. The potential upside is substantial.

For further discussion on how a product management culture can benefit your institution, please contact Ben Crowley at bcrowley@kafafiangroup.com.