This was the question posed to Bank Profitability students as part of the Oregon Bankers' Association's Executive Development Program (EDP). These were up-and-coming bankers, the future leaders of our industry, identifying industry trends that will have the greatest impact on their bank, in no particular order.

1. Interest Rates

So many financial institutions had a positive GAP (assets that are maturing or repricing within one year minus liabilities that are maturing or repricing within one year) during the Fed's ambitions five quarter rate hike from zero to 5.25%, meaning that they were asset sensitive and their net interest margins should have expanded. And then what happened in 2004-06 happened again. Depositors woke up and thought "what is my bank paying me?" And our cost of funds chart looked like the trail lift at Breckenridge. The Fed has paused for nearly a year now, and it was our experience in 2006-07 that bank cost of funds continued to increase as the market closed the delta between what someone could earn in a money market mutual fund and a bank account. Cost of funds is leveling off now. But not until $1 trillion went from banking to money markets. Will NIM compression continue, as it did last year (see chart from American Banker)? Will bankers reposition their balance sheet to be liability sensitive so NIMs will improve with falling rates? And will their ALCO reports accurately predict what will happen? Time will tell and it is weighing heavily on bankers' minds as the most impactful to their banks' success. And with our industry still heavily dependent on net interest income for revenue, I think they are right.

2. Consumer Demographics and Changing Customer Demands

Remember all the pre-pandemic talk about millennials? You couldn't go to a conference without every presenter having millennial this or millennial that on their slide decks. They are digital native, meaning they never knew life without the Internet. We've been able to ignore them because, well, they didn't have big borrowing needs nor did they have any money in their deposit accounts. Besides what was needed to buy some Keystone Light and Vlad for this weekend's party. Now the oldest millennial is 43 (see table by Statista). They have cars, houses, and are nearing their peak earning years. They are starting businesses and inheriting money from The Greatest Generation and Baby Boomers. In other words, great bank clients with high lifetime values. In fact, there are segments of millennials that have always had high lifetime values. That's why Sofi went after them at the end of college, focusing on the engineering majors and leaving the English majors to others. High lifetime value. Now we have to tailor what we do, how we do it, and how we differentiate to these young whippersnappers that never had to scroll through library microfilm when researching a college paper. Our tortoise approach worked when Baby Boomers controlled the wealth. EDP students fear it will work no longer.

3. Shadow Banking

This trend seemed very specific to current commercial lender anxiety today. Because of our current liquidity situation, where depositors now carry lower average balances per account, the aforementioned trillion that went to money market accounts, and our bond portfolios being underwater, nearly every banker is hunting for deposits. As part of that full-court press, commercial lenders are being asked for higher and stricter compensating balances from borrowers. Experienced borrowers are feeling the pinch from the multiple banks they deal with. And, according to some EDP students that are lenders, are turning to the shadow banking market that do not have deposit demands. Such as direct lending funds, and insurance companies. Shadow Banking refers to banking-like operations that take place outside of the mainstream banking industry. Shadow bank lending is similar to bank lending but is not subject to the same regulations, and compensating deposit balace requirements. Typical shadow banking entities are bond funds, money market funds, finance companies, and special purpose entities. Business Research Insights estimates the worldwide shadow banking system to be over $53 trillion in 2021 and believes it will grow to $85 trillion by 2031, a 5% compound annual growth rate (see table). Although shadow banking mostly serves larger corporations, think money market funds buying commercial paper, bankers fear the trend will continue going downstream to more traditional community bank customers.

4. Commercial Real Estate Uncertainty/Vacancy Rates

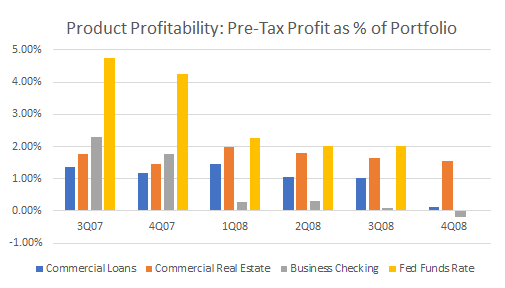

Nineteen point six percent of office space is vacant at year end 2023, according to Axios.com (see chart). Vacancy reached a record high in the fourth quarter and surpassed previous peaks last reached in 1992. Office buildings are emptying around the U.S., as companies continue to adapt to the new norms of remote and hybrid work by shrinking their real estate footprint. Although large office towers in big cities are not usually part of a community financial institution loan portfolio, smaller commercial real estate in urban areas and throughout suburbia and rural markets are. Commercial rents are projected to decrease by a small amount this year, while borrowing costs will escalate as those that borrowed in the low interest rate environment of 2017-19 have their loans coming due, some at twice the rates of their maturing loan, putting pressure on debt service coverage ratios. Rents are lower, borrowing costs are higher. Do bankers make exceptions to policy, ask borrowers to kick in more equity, or push borrowers out of their bank? There's better news for multi-family and warehouse lenders, as these sectors of CRE are doing just fine. But bankers should be preparing for a devaluation of the collateral used by their borrowers to determine how best to manage this emerging situation.

5. Regulation and the Political Environment

"Last month, the CFPB reported how banks have become more dependent on these fees to feed their profit model on checking accounts. In 2019, bank revenue from overdraft and non-sufficient funds fees surpassed $15 billion with the average cost of each charge between $30 to $35. But that's not the only product where large financial institutions feast on their customers through fees. In 2019, the major credit card companies charged over $14 billion each year in late fees with an average charge of around $35. And when buying a home, there's a whole host of fees tacked on at closing where borrowers feel gouged."

~ Rohit Chopra, CFPB Director, January 26, 2022

"I am pleased to support this adoption (of required climate disclosures) because it benefits investors and issuers alike. It would provide investors with consistent, comparable, decision-useful information, and issuers with clear reporting requirements."

~ Gary Genslar, SEC Chairman, March 6, 2024

"The CFPB and other regulatory bodies will use the disclosures required by Rule 1071 of the Dodd-Frank Act as a cudgel to pressure bankers to lend to politically favored small businesses or to not lend to politically disfavored small businesses."

~ Jeff Marsico

6. Technology Advancement and Generative Artificial Intelligence

In the third quarter of 2023, the total operating expense to operate a branch was 47% direct cost: branch salaries and benefits, lease expense, etc. and 53% indirect costs: operations, IT, human resources, etc. This is a hefty burden to put on a branch that is competing with branchless banks that don't incur the direct costs and can pass that on to depositors in the form of higher interest rates. Bankers must get serious about driving down the cost of the pistons, carburetors, and batteries of running a bank. Technology offers opportunities to do just that. Additionally, customer acquisition is another significant cost to financial institutions. Technology and Generative AI could dramatically lower those costs. As well as compliance, fraud, credit, reconciliations, reporting, and other risk mitigation that is currently performed in a resource intensive way. The opportunity to lower costs without escalating risks, in fact likely lowering risks, is near. EDP students think this could have a significant impact on their banks.

7. Branch Consolidation

Community financial institutions are caught in this place where they want to demonstrate commitment to the communities where they operate yet can't figure out how to do it profitably in certain locations. Large financial institutions simply consolidate their branches. Community bankers still consider this as a sign of weakness to the market, lack of commitment to its leaders and residents, and admission to a mistake to enter the market in the first place. This, of course, was a Bank Profitability course, and when staring in the face of hard data, namely a branch's income statement showing perpetual red ink, it becomes more difficult to justify keeping the branch open with those soft reasons such as not supporting the community. I got news for you, if you can't operate a branch profitably and you are satisfied that the reason is not because of poor execution by your bank, perhaps the community doesn't support you.

~ Jeff