Chris Nichols from Southstate Bank Correspondent Bank Division recently wrote an excellent piece about branch profitability, a subject near and dear to my heart because it is one of our core competencies at my firm, The Kafafian Group, Inc.

In that piece, titled Branch Profitability in 7 Steps Using Data, Step 1 was start with Potential Branch Profitability. In that step, Chris made the case for calculating relative profitability to the competition using hypotheticals. And I thought, what if we didn't use hypotheticals? We used our actual profitability metrics, synced them up with our strategic plan, and calculated our journey from current profitability to desired profitability?

This is a tall order because in my experience, branch profitability is not widely calculated, and certainly not widely used in creating the operating discipline needed to deliver to the bank's stakeholders. Instead, it is more common to use easily available metrics that we can draw from our general ledger, core processor, or other systems. We measure aggregate deposit growth, period over period expenses, and number of accounts opened.

But what if this motivates behavior that is not consistent with strategy? For example, growing aggregate deposits might be aligned with overall asset growth objectives, but at what cost? It's a sure way to have the un-empowered branch manager calling the regional manager for rate exceptions to win new money or keep money at the bank.

I rarely hear bankers state as a strategic objective to grow assets, loans, or deposits at any cost. But that is certainly what you are motivating branch managers to do if you use deposit growth as one of their strategic goals.

Instead, what if the bank aspires to be the number one business bank in their markets? And a strategic objective is to achieve top quartile cost of funds with an emphasis on growing business deposits?

How does that translate to the branch manager? What's their plan?

I'm currently reading Extreme Ownership, How U.S. Navy SEALS Lead and Win, by Jocko Willink and Lief Babin. This book was given to me by a banker, by the way. In the book, the authors say this about empowering junior leaders, like branch managers (parentheticals are mine):

"Teams must be broken down into manageable elements of four to five operators (i.e. a branch), with a clearly designated leader (i.e. a branch manager). Those leaders must understand the overall mission, and the ultimate goal of that mission. Junior leaders must be empowered to make decisions on key tasks necessary to accomplish that mission in the most effective and efficient manner possible. Teams within teams (i.e. retail/small business banking-regionals-branches) are organized for maximum effectiveness, with leaders who have clearly delineated responsibilities. Every tactical-level team leader must understand not just what to do but why they are doing it."

So what of that Schmidlap National Bank plan: Vision-Be the number one business bank in our markets. Strategic Objective-Achieve top quartile cost of funds with an emphasis on growing business deposits.

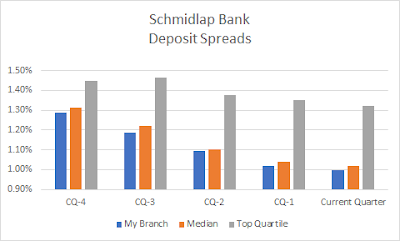

The head of retail, or the regional manager if a larger bank, can set the strategic goal for the Elm Street Branch (My Branch in the below chart) to achieve top quartile deposit spread in the branch network.

Deposit spread is a key metric in any worthwhile branch profitability system. Understanding how deposit spread is calculated and how to impact it is easily taught and understood. I wasn't from the Finance function, and I once was a branch manager, and I understand it. In fact, I believe not using branch profitability because we don't think branch managers, regional managers, or even the head of retail/ small business banking will understand it is patronizing. Or quite possibly you've made these reports overly complex. Which is the enemy of effectiveness.

No, I think My Branch's goal of achieving top quartile deposit spread by some future period is specific, measurable, aggressive yet achievable (a quarter of your own branches achieve it), relevant (to the strategic objective), and time based (i.e. a SMART goal).

After setting the strategic goal, and ensuring the branch manager understands how it is calculated and how to impact it, the regional manager can then empower the branch manager to develop a tactical plan to achieve it. Some may include dependencies, as many of the Chris Nichols' "7 Steps" require Marketing support. This support can be coordinated over the franchise, as in "how will Marketing help our branches achieve their goals?"

But this doesn't mean the branch manager can't highlight tactics to help the branch succeed, such as:

1. Develop list of businesses within five miles of branch by NAICS code, cross reference with existing branch customers.

2. Focus on the most promising businesses' in industries where our bank can be successful competitively.

3. Perform competitor analysis using Amberoon tool (Step 3 in Chris Nichols article)

4. Leverage bank-developed and curated business-focused content to communicate with businesses identified in (2).

5. Branch manager/assistant branch manager to complete ABA Small Business Banker certification.

6. Implement business calling program as developed/instructed by [Internal training/ external consultant, etc.]

This, of course, is a summary list of strategic initiatives to achieve the goal that emanated from the whole bank's strategic objective to "achieve top quartile cost of funds with an emphasis on growing business deposits."

And if the bank is a learning organization, then each branch is empowered to experiment (within guidelines) to develop what works well, what must be refined, and what doesn't work. If the bank creates appropriate feedback loops, this can exponentially increase the effectiveness of strategic initiatives that are laser-focused on achieving the overall bank strategic objectives and vision.

It is the very definition of rowing in the same direction. And it creates a culture where branch managers own their role in strategy execution, goal achievement, and the tactics to succeed.

Have you experienced this level of ownership?

~ Jeff

Notes:

I mentioned that profitability reporting is a core competency of my firm. To learn more, click here.

And please consider reading my book: Squared Away-How Can Bankers Succeed as Economic First Responders.

Ten percent of author royalties go to K9sForWarriors.org, who work to bring down the suicide rate among our veterans.

Thank you!

No comments:

Post a Comment