"That's all fine and good, but if your bank doesn't do it or the reporting doesn't get to the front line, how can we improve?"

~ Montana Bankers' Association Executive Development Program Student

Sing from the same sheet of music. Row in the same direction. Everyone should be on the same page.

Do we really want this?

Few have access to information at the line of business, product, or relationship level. Branch managers were unaware of their P&L, lenders were unaware of the ROE of their portfolio. And for me... disappointment.

Because if we want everyone from the Board Room to the customer contact person to "sing from the same sheet of music", why on earth do we have executive incentives tied to Return on Equity but hold lenders accountable for loan volume? It is inconsistent. In fact, it incents lenders to work against your ROE, promoting larger, thinly priced deals without regard for structure, duration, or capital needed to support the loan. It is the antithesis of "rowing in the same direction."

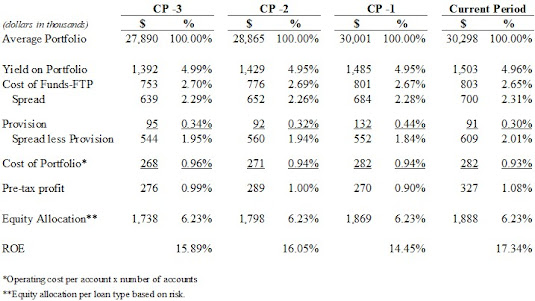

Imagine, holding lenders accountable for the continuous pre-tax profit and ROE improvement of their loan book, like the table below.

We either: don't do this (most likely), or do this but allow naysayers to poke holes into the art part of management reporting because they don't look particularly good (lack of leadership), or do this and keep it bottled up in the executive suite (nice to know). I realize my firm has self-interest in the first reason because we do this on an outsourced basis for financial institutions. But that aside, everyone should do this! Imagine the behavioral changes this would foster. Behaviors we now try to control with incentive schemes to offset the unintended negative consequences of incenting on volume.

I recently wrote about Branch Profitability in Practice, so I won't belabor the point on holding branches accountable for continuous profit improvement. A bank CEO recently asked me if I thought using branch pre-tax profit rankings amongst all of his bank's branches would be an incentive that is consistent with the bank's strategy. Knowing the CEO's passion about being a superior financial performer, of course it would! His top quartile branches in pre-tax profit should receive a greater bonus pool than his bottom quartile. Again, this bank has the luxury to do this, because they measure profitability of their branches. Those that don't use deposit growth, or net new accounts, or some other metric that's easy to get out of their core but may not be consistent with strategy.

Don't leave support centers in the lurch. If you incent your Compliance Department with no audit exceptions, should it be a surprise that it was next to impossible to get online account opening off of the ground when branchless banks have been doing it for a decade? How about incenting them on how quickly audit exceptions are cured? Think of the cultural change.

There are ways to incent other support centers to row in the same direction as strategy. If the executive team is incented on being efficient compared to peer, wouldn't it be consistent to incent the Loan Servicing Department on their operating expense to average loans? That combined with loans serviced per Loan Servicing FTE would make for a transparent incentive that has that Department singing from the same sheet of music as the overall bank.

I think I've thrown enough management bromides at you.

We continue to talk about implementing the solutions to serve our most valuable customers without having any idea who the most valuable customers are. Imagine if the lender had 50 relationships, 10 over his/her ROE hurdle rate (white glove service), 20 hovering at or under the hurdle rate (take action to get them over it), and 20 are far under the hurdle rate (efficiently serve them). But we don't do it.

Imagine if the branch gave the best service to those customers most valuable to that branch. If only they knew who they were. Maybe we should.

Instead of accepting how we currently do it, perhaps we should do it like it should be done. In a changing financial world full of shiny objects and the need for focus, we should know the profit trend of the residential lending department, our commercial lenders, our branches, and our most valuable customers. How else would we know they are the most profitable?

Stop accepting incentives not consistent with strategy. Don't leave profitability behind in your data journey.

Just Do It!

~ Jeff

Jeff – Another great post. A few items to add to the discussion.

ReplyDelete1) In a business of numbers, it helps to know the numbers. It’s amazing how this truth is lost in the daily grind of work. I’m currently watching WeCrashed (the dramatic interpretation of the rise and fall of WeWork). It’s full of great examples of pay for activity and pray for results; all while ignoring the reality of the simple rule that profit is the difference between revenue and expense.

2) Improvement in profitability is as important as rate of return. I like to define units/individuals as either high yield bonds, growth stocks, or rationalize continued investment. High yield bonds are the most profitable ones that are sustaining franchise value -- continue to clip the coupon there. Growth stocks are ones who are increasing franchise value via earnings growth. The lesson here is less profitable units, that are growing earnings at an acceptable rate, are just as valuable as the most profitable.

3) Lenders write contracts stockholders must honor. Hold them accountable for the value of those contracts, over the life of the contract. This reinforces the importance of both credit and interest rate risk when evaluating who is doing what for shareholders.

Mike

"Improvement in profitability is as important as rate of return." Amen, Mike. It builds culture. Particularly if you're talking long-term profit improvement so we don't ignore strategic investments. Thank you for the comment!

ReplyDelete